NAIOP Research Directors Discuss an Industry in Transition

At their annual meeting, research directors shared their outlooks for capital markets, office, retail and industrial real estate.

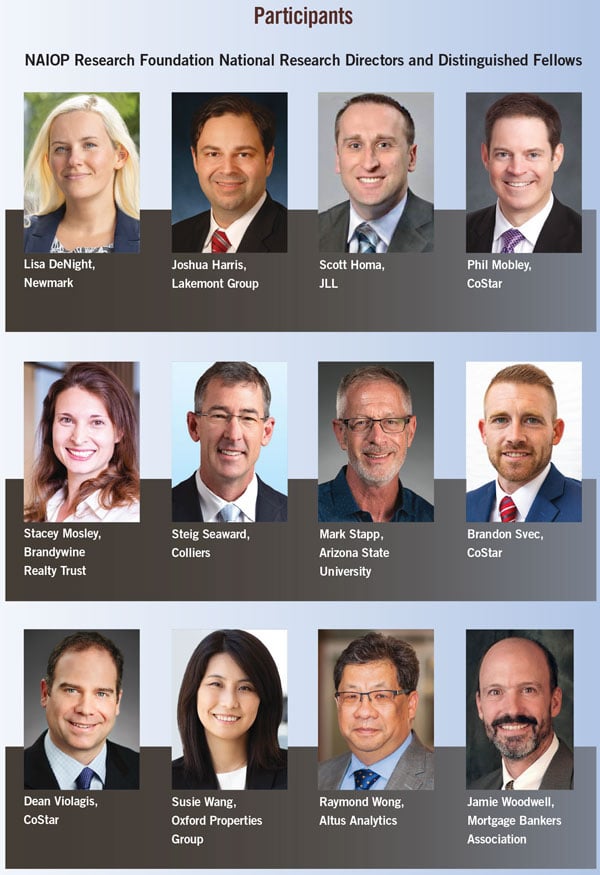

The NAIOP Research Foundation held its National Research Directors Meeting in September in Washington, D.C. The conversation was facilitated by Jennifer LeFurgy, Ph.D., the Research Foundation’s executive director, and Shawn Moura, Ph.D., NAIOP’s director of research, and brought together research directors from national real estate brokerage, data and investment firms. Mark Stapp, executive director of the Master of Real Estate Development program at Arizona State University and a NAIOP Research Foundation Distinguished Fellow, also joined the discussion, which explored how recent capital market and demand trends are shaping the outlook for commercial real estate.

Insight Into the Debt Market

Jamie Woodwell, vice president and head of commercial real estate research at the Mortgage Bankers Association (MBA), gave a presentation on the outlook for CRE finance, which touched on interest rates, debt availability, and delinquency rates for commercial and multifamily mortgages. As interest rates have risen, demand for new commercial mortgages has declined. It appears that data series tracking cap rates have not yet fully adjusted to the new interest rate environment, with the spread between average cap rates and U.S. 10-year treasury bonds reportedly as narrow as it was in 2006. Relatively low reported cap rates are likely a product of limited transaction volume, which has made it difficult for both buyers and lenders to value buildings in the absence of recent comparable sales.

Lenders have been generally avoiding new office loans but remain open to mortgages for other property types. Woodwell explained, “From an equity investor’s perspective, you’re willing to take a risk if you think that there is a potential big payout. If you’re a lender, there is no upside besides getting paid back. And so, lenders are looking at office and the uncertainty there and saying, ‘Why do I want to make this loan as opposed to something else?’” Woodwell noted that the next step is likely for investors and lenders to begin differentiating between office properties that they feel more — and less — comfortable with and for activity to begin to pick up among the former. More conservative underwriting is also affecting loans for other property types. By the end of 2023, Woodwell expects commercial loan origination volume to be down about 40% year over year.

Higher interest rates also present a challenge to refinancing existing loans and for floating-rate loans that are resetting at higher rates. Buildings with longer-term loans are more likely to be able to refinance at current rates than those with shorter-term loans. The difference in interest rates for a mortgage originated 10 years ago and today’s rates are smaller than for a mortgage originated two years ago, and a building approaching the end of a 10-year mortgage has had more time to appreciate than one with a two-year mortgage.

Overall delinquency rates have yet to significantly increase, but that could change with the large volume of loans maturing in 2023 and 2024. Woodwell observed that lenders have generally been willing to work with borrowers, asking them to post additional equity, but extending loans so long as cash flows are sufficient to cover debt service and maintenance. However, the expectation until recently had been that interest rates would soon decline, leading to a rebound in property values, which now seems less likely. With a growing consensus that interest rates will stay higher for longer, lenders may increasingly prefer to get delinquent loans off their books.

Demographics and Migration

Meeting participants exchanged views on the demographic trends that are affecting demand for commercial real estate. Woodwell observed that millennial household formation has in recent years resulted in migration from urban areas to the suburbs and in interstate migration toward the Sun Belt as young families seek more affordable and spacious housing.

Raymond Wong, vice president of data solutions delivery at Altus Analytics, observed that “with work from home, you see maybe a little bit more opportunity in the secondary and tertiary markets than in the larger markets. In Canada, we look at interprovincial migrations, and they are moving to where it is a little bit more affordable.” Those markets will benefit from the new talent that has moved there, making them more attractive to employers and providing growth opportunities for investors.

However, migration to smaller markets may be ending as more companies adopt hybrid or in-person work requirements for their employees. Scott Homa, JLL’s senior director of property sectors research for the Americas, noted that migration to Sun Belt markets has recently slowed as they have grown more crowded. “The cost-of-living advantage has diminished, infrastructure constraints are an issue, and corporate migration has slowed,” Homa said.

Brandon Svec, national director of retail analytics at CoStar, added that millennial migration to the suburbs was not solely a pandemic phenomenon and could be expected to continue. “They’re not going to be the first generation since World War II to raise their children in urban apartments,” Svec said. He conceded that millennials have been marrying and having children later in life than past generations, but “they’re still getting married, they’re still having children, and when they do, that’s going to be in the suburbs. It’s not going to be in the primary gateway markets.”

Future of Office Remains Uncertain

Although the COVID-19 public health emergency officially ended earlier this year, office utilization is not yet high enough to support growth in leasing activity, and nationwide vacancy rates continue to climb. Meeting participants expressed a variety of opinions about the trends affecting the office sector and how quickly it will recover.

Homa voiced optimism for the office sector, with occupancy having recovered recently. “It seems like the tension has shifted very dramatically from ‘work from anywhere’ to ‘let’s get back to the office,’” he said. Nonetheless, he acknowledged that buildings with loans that are maturing soon face a challenge given the significant tightening of debt and credit markets.

Phil Mobley, national director of office analytics at CoStar, suggested office fundamentals are likely to deteriorate further. He noted that a long-term shift to hybrid work schedules would not translate to a 40% reduction in demand for

office space from pre-pandemic levels, but that some companies may be able to cut 10% fairly comfortably. Occupiers are also continuing a longer trend of leasing less space per worker as they migrate to smaller but higher-quality office space. “Even if we return to pre-pandemic attendance levels, which seems unlikely, we are going to have structurally lower office demand, because we have been shrinking the ratio of occupancy per worker for a decade,” Mobley explained.

Wong observed that in the near term, a large volume of sublease space is creating headwinds for building owners. “The good thing about the sublets is that they are starting to burn off,” Wong said, “but some of these sublet opportunities are fully furnished office space that landlords can’t really compete with.”

Homa added that the technology sector was responsible for much of the subleasing activity across the U.S. “It’s everywhere, and it’s really high-quality space in some cases.”

Joshua Harris, managing partner at the Lakemont Group, added that because most office-using businesses still face significant uncertainty around long-term staffing decisions, they are reticent to sign 10- or 15-year lease agreements. Instead, he suggested more landlords might consider following the hospitality industry’s example by providing turnkey spaces under a shorter-term lease: “If you want a two-year lease, this is what your space looks like.” Avoiding repeated capital expenditures for tenant improvements would help to compensate building owners for the uncertainty associated with shorter leases.

It was generally agreed that occupiers are looking for office buildings in vibrant locations that can attract employees and that the least desirable locations are those with few other uses in the surrounding area. “Regardless of whether you are in a CBD or suburban area, if you are in a commercially diverse neighborhood, then the office component will perform better than if you are in an office-dominant neighborhood,” said Mobley. “Workers prefer having nearby retail options if they are going to commute to work.”

Stapp shared that the challenges now facing the office sector reminded him of retail real estate after the Great Recession, when it had to adapt to new technologies and changes in consumer preferences. Similarly, the office sector is still in the early stages of figuring out how to adapt to workers’ new preferences and behaviors.

Weighing the Prospects for Office Conversions

Office-to-multifamily conversions have been a topic of discussion over the past year, particularly in municipalities facing high vacancy rates and a shortage of affordable housing. Meeting participants generally agreed that more conversions are likely in the years ahead, but that a variety of factors currently limit their feasibility to a small share of existing office buildings.

Steig Seaward, senior director of national research at Colliers, summarized how attractive conversions seem in theory: “Conversions are a wonderful story, a fantastic story, and would check so many boxes, but they are very dependent on feasibility.” Office-to-residential conversions, especially for market rate or affordable housing, will need supply-side incentives for the projects to be financially successful.

Stapp observed that crime and homelessness have become a street-level problem for office-centric CBDs in cities where housing affordability is a challenge and office attendance has been low. Cities will need to weigh the social costs of vacant office buildings against the costs of subsidies to convert them. Stacey Mosley, director of research at Brandywine Realty Trust, added that “more research needs to be done to determine the long-term impact on the real estate tax income for cities to determine the need for those subsidies sooner than later.”

Multifamily may not always be the best use for an old office building. Wong noted that municipalities will often prefer to preserve employment opportunities in their downtowns, and local residents may oppose new multifamily construction. In some cases, life science or even data center conversions may be a more feasible option. Harris added that in the suburbs, low-rise office parks can be more easily redeveloped to a new use than converted.

Whether through conversion or redevelopment, Stapp emphasized that functionally obsolete office buildings will eventually need to make way for new uses. “Real estate is nothing more than a service to society,” he said. “When society changes, the service we provide has to change.”

Retail Continues to Evolve

The outlook for retail has improved, with strong demand for retail space in suburban areas. Svec observed that recent migration and a lack of new supply are largely responsible for improved market conditions. “In the suburbs, you can’t find an available box under 10,000 feet. There just isn’t any space available. It’s similar to what happened with the single-family housing market. If you structurally underbuild something for a decade, eventually, you will no longer be oversupplied.” With little space currently under construction, he expects the market for suburban retail to remain tight for the next two to four years.

The exception to this trend is the Class B and C malls, which continue to struggle. “They’re on a doom loop,” Svec observed. “First, they lose anchors, then foot traffic declines, and then the in-line stores leave. If one of your largest tenants is a comic book store, you’re probably not going to be around in five years.” However, these malls’ locations may make them attractive targets for conversion to new uses.

In contrast with the generally strong demand for retail space in the suburbs, Svec remarked that the outlook for retail in central business districts varies. Traditional office-centric downtowns are experiencing high retail vacancy rates, but there are lower vacancies in CBDs that have a more balanced mix of uses, including multifamily.

Retailers have also continued to embrace omnichannel distribution strategies that see more stores being used for e-commerce fulfillment. According to Svec, stores that are used this way typically see around 15% of the store’s footprint allocated to back-of-store fulfillment, compared with 5% of space located behind the back wall in a traditional layout.

Manufacturing a Bright Spot in Cooling Industrial Market

Although industrial real estate continues to enjoy rent growth and low vacancy rates in most major markets, demand for distribution space remains cool. Lisa DeNight, managing director of national industrial research at Newmark, expects that the supply of new industrial space will likely outpace demand until the first quarter of 2025. A large volume of projects begun in late 2022 have yet to be delivered, and there is now about 545 million square feet of industrial space currently under construction. In earlier years, many of those projects would have already been delivered, but industrial construction timelines continue to be longer than before the pandemic, with ongoing supply chain delays, particularly for components like electrical equipment.

DeNight expects the market for larger distribution buildings will be most affected by the expected increase in supply. “In square footage, the pipeline is concentrated in megabuildings, which have seen the most decline in demand,” she said. In some geographic markets, there are signs that developers may have overbuilt in relation to historical demand, at least in the short term. DeNight shared that in the Dallas metropolitan market, more than 20 warehouses over 700,000 square feet in size were just delivered or are currently under construction and are not pre-leased.

Recent trends also suggest that while there is a shrinking appetite for new construction in Southern California currently, given economic conditions, there are increasing longer-term barriers to development in that market, with development shifting to adjacent states or more-distant port markets. Regarding the ports in Los Angeles and Long Beach, DeNight remarked that “the port isn’t going anywhere, but it is losing some TEU market share.”

Manufacturing construction is picking up some of the slack in the industrial market, with the nearshoring, reshoring and domestic expansion of advanced manufacturing plants leading the way. DeNight shared that manufacturing growth has been concentrated in plants for electronic vehicles, batteries, solar, biomanufacturing and semiconductors. These new plants are large, with an average building size of around 1.5 million square feet. While manufacturing spaces generally command higher rents than warehouses, most of the new construction will be owner-occupied. Reshoring construction activity is occurring nationwide, but many projects are in rural and exurban areas that are adjacent to manufacturing and high-tech labor pools.

Shawn Moura, Ph.D., is the research director at NAIOP.

RELATED ARTICLES YOU MAY LIKE

Construction Cost Challenges Shift from Materials to Labor

A limited supply of experienced workers pushes wages higher.

Read More

The Logistics Building of the Future

A new prototype aims to solve the challenge of putting industrial facilities in dense urban areas where land supplies are constrained.

Read More

Costs Cool Down, but Not for All Construction Items

Products such as concrete and flat glass are seeing record-setting price increases.

Read More