Industrial Space Demand Forecast, Third Quarter 2021

Release Date: August 2021

Industrial Space Demand Remains Strong

Demand for industrial real estate continues to be strong as the long-term trend toward e-commerce (and away from in-store sales) continues with no end in sight. With nearly 100 million new square feet delivered nationally since the beginning of the year, 450 million square feet currently under construction and another 450 million planned, the demand for industrial real estate still outpaces supply.1

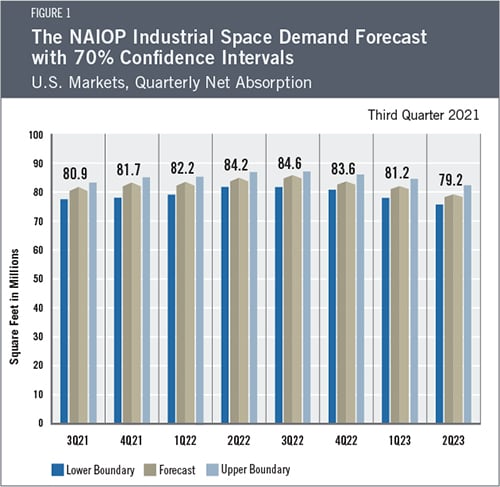

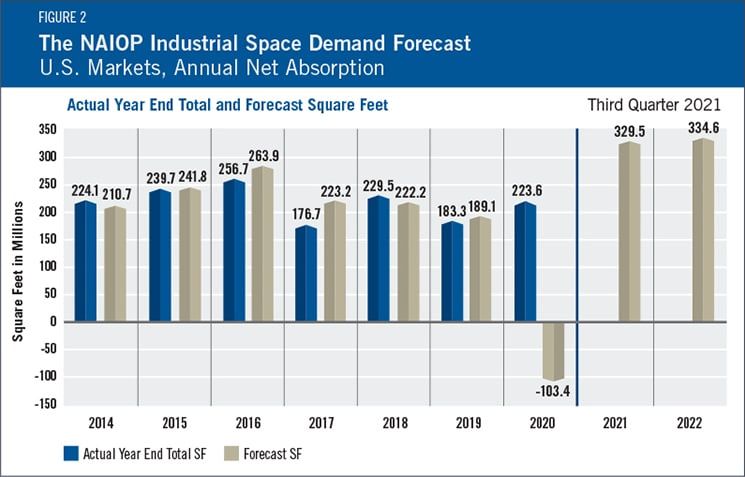

Because of this, authors Dr. Hany Guirguis and Dr. Michael Seiler forecast that total net absorption in the second half of 2021 will be 162.6 million square feet with a quarterly average of 81.3 million square feet. In 2022, the projected net absorption is 334.6 million square feet with a quarterly average of 83.6 million square feet. An improvement in the outlook for the economy in 2021 and 2022 is behind the upward revision of the 2022 forecast. For example, the real GDP growth rate is now forecast to be 7% in 2021, above the previous forecast of 5% growth. As economic growth is projected to revert toward long-term growth rates in 2023, net absorption in the first half of the year is forecast to be 160.5 million square feet, for a quarterly average of 80.2 million square feet.

Led by coastal port cities, industrial transaction prices per square foot are on the rise, vacancy rates remain low and new leases are being signed at higher rates. Despite new current and planned supply that is greater than it has been in years, higher demand for industrial real estate is causing net absorption to remain strong. A continued surge in imports from retailers restocking depleted inventories has exacerbated the shortage of warehouse space near major logistics hubs, highlighting the need for additional construction.2 Although supply chain disruptions are less severe than earlier this year, the cost of building materials remains above pre-pandemic levels, and construction workforce shortages may delay industrial completions. Strong returns on industrial real estate have continued to attract investment in the sector, contributing to higher transaction prices and additional development. There is continued need for more last-mile industrial space and cold-storage facilities, which supports a premium for properties adjacent to more densely populated areas.

Economic Trends

Unemployment rates have fallen, many firms report shortages of qualified workers, and school re-openings will allow some currently unemployed parents to return to the workforce in the fall. During the pandemic, savings rates increased and demand for consumer goods surged. Consumer preferences have shifted recently from saving to consumption of both goods and services, despite burgeoning inflationary concerns. But just when the nation seemed to be turning the corner on COVID-19, the Delta variant has renewed concerns about the pandemic’s impact on the economy. If the uptick in infections and hospitalizations continues, consumers could again shift more of their purchases from in-person stores and services to e-commerce, which would support additional demand for industrial real estate.

The Forecast Model

In the statistical model, the authors utilize various explanatory drivers such as the lagged net absorption, growth in real gross domestic product, inflation and output gaps, monetary policy and seasonal effects. The confidence intervals have narrowed to the pre-pandemic forecasts as economic conditions have stabilized.

Actual Versus Forecast

Net absorption in 2020 was higher than in 2019, reflecting a surge in ecommerce-related activity in the second half of the year (see Figure 2). During 2020, 223.6 million square feet of industrial space was absorbed, compared with the forecast of -103.4 million square feet.

Key Inputs and Disclaimers

The predictive model is funded by the NAIOP Research Foundation and was developed by Guirguis and Randy Anderson, PhD, formerly of the University of Central Florida. The model, which forecasts demand for industrial space at the national level, utilizes variables that comprise the entire supply chain and lead the demand for space, resulting in a model that can capture most changes in demand.

While leading economic indicators have been able to forecast recessions and expansions, the indices used in this study are constructed to forecast industrial real estate demand expansions, peaks, declines and troughs. The Industrial Space Demand model was developed using the Kalman filter approach, where the regression parameters are allowed to vary with time and thus are more appropriate for an unstable industrial real estate market.

The forecast is based on a process that involves testing more than 40 economic and real estate variables that theoretically relate to demand for industrial space, including varying measures of employment, GDP, exports and imports, and air, rail and shipping data. Leading indicators that factor heavily into the model include the Federal Reserve Board’s Index of Manufacturing Output (IMO), the Purchasing Managers Index (PMI) from the Institute of Supply Management (ISM) and net absorption data from CBRE Econometric Advisors.

Authors

Hany Guirguis, PhD, Professor, Economics and Finance, Manhattan College

Michael J. Seiler, DBA, J.E. Zollinger Professor of Real Estate & Finance, College of William & Mary

Media Inquiries

Please contact Kathryn Hamilton, vice president for marketing and communications, at hamilton@naiop.org.

1 CommercialEdge National Industrial Report, July 2021,

https://www.commercialedge.com/blog/national-industrial-report-2021-july/.

2 Paul Berger, “U.S. Import Surge Overwhelms Warehouse Space Near Ports,” The Wall Street Journal, July 29, 2021,

https://www.wsj.com/articles/u-s-import-surge-overwhelms-warehouse-space-near-ports-11627586691.