Will Construction Thrive or Dive in 2025?

An annual outlook survey suggests that contractors are cautiously optimistic about current-year prospects.

Construction contractors began 2025 with a mix of optimism and concern. Meanwhile, uncertainty about a wide range of policies affecting the industry has made the outlook even foggier.

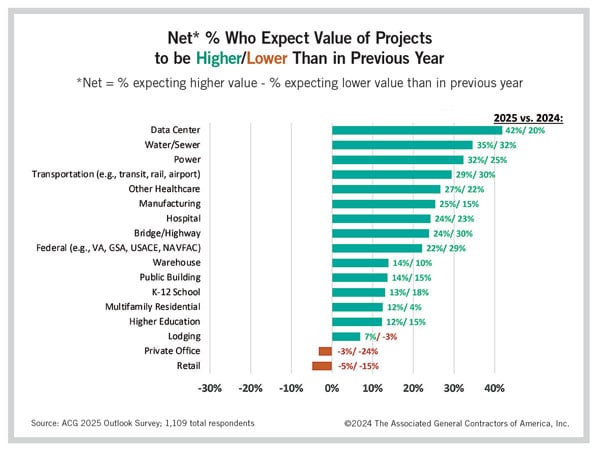

In an annual outlook survey conducted by the Associated General Contractors of America (AGC), more than 1,100 contractors provided their views about whether the dollar value of projects available to bid on would be higher or lower in 2025 than in 2024. Responses were sent from just after Election Day until shortly before the Federal Open Market Committee met in mid-December. At that meeting, members voted to lower their short-term interest rate target but signaled they might reduce rates less often in 2025 than had previously been expected.

AGC reported contractors’ outlook for 17 types of projects by measuring the net reading — the difference between the percentage of respondents who expect opportunities to increase minus the percentage who expect it to shrink. Contractors expressed the highest degree of optimism regarding data centers, with a net positive reading of 42 percentage points. Their bullishness about that segment increased by 22 points from the prior year’s survey.

Respondents were also optimistic about the prospects for several categories of infrastructure, as well as power and manufacturing plants. Among more commercially focused segments, contractors were most optimistic about health care projects other than hospitals, such as clinics and medical offices. The net reading for these projects climbed to 27 percentage points from 22 a year earlier.

Respondents were moderately upbeat about warehouse construction, with a net reading of 14 points, up from 10 in the 2024 survey, and multifamily residential building, with a net of 12, compared to 4 a year before. Their expectation for lodging construction shifted from a negative 3 points in 2024 to a positive 7 points.

The outlook for two categories remained negative but much less so than in 2024. The net reading for private office construction rose from -24 points in 2024 to -3 points, while the net for retail increased from -15 to -5.

Whether these expectations are ultimately realized depends in part on how federal policies unfold regarding immigration, tariffs, taxes, spending and regulations. Construction has more at stake than many sectors with respect to each of these policy areas.

The most disruptive changes to the construction outlook would occur with a tightening of immigration, especially if the Trump administration carries out “mass deportations.” An analysis of data from the Census Bureau’s American Community Survey indicates that roughly one-third of construction craft workers in 2023 were foreign-born. Even if deportation efforts are limited to immigrants lacking permanent legal status, past episodes have shown that even legal immigrants often react by avoiding jobsites that may be raided. Such a response would greatly worsen the construction industry’s ongoing challenge of finding qualified workers.

Tariffs would potentially drive up the cost of lumber, steel, aluminum, and a host of components, parts and machinery used in construction or installed in structures. Moreover, tariffs are likely to trigger retaliatory actions that would hit demand for many processing, manufacturing and logistics structures.

Many contractors would welcome the extension of some tax reductions that were enacted in 2017 and are due to expire at year’s end. However, to hold down the revenue loss from these cuts, Congress might end a range of tax incentives that have boosted demand for construction of renewable energy and advanced manufacturing facilities. In addition, some funding for infrastructure, power and manufacturing construction may be scaled back to offset the cost of tax cuts or new spending initiatives.

While the Trump administration seems certain to propose fewer new regulations that limit construction or make it costlier, the repeal of existing rules could be time-consuming and is not assured.

In short, contractors have generally high hopes for 2025 but also reason to be cautious in their optimism.

Ken Simonson is the chief economist with the Associated General Contractors of America. Contact him at ken.simonson@agc.org.