An Update on Commercial Real Estate’s Contribution to the U.S. Economy

Data center and retail construction picked up as office and industrial activity slowed.

The NAIOP Research Foundation published the 2025 U.S. edition of the “Economic Impacts of Commercial Real Estate” report in January. The report revealed that commercial construction initiated in 2024 contributed $544.7 billion to U.S. gross domestic product and supported 2.7 million jobs. Both figures represent a second year of declines from when new commercial construction activity peaked in 2022 and contributed $696 billion to GDP. Commercial real estate development in 2024 nonetheless remained significantly elevated when compared with pre-pandemic activity, and the report expressed measured optimism that conditions for development will improve in 2025.

The report, authored by Brian Lewandowski, Adam Illig, Ethan Street and Richard Wobbekind, Ph.D., draws from construction expenditure data provided by Dodge Construction Network (DCN), a NAIOP construction cost survey, and data published by the U.S. Census Bureau to estimate the economic contributions of new commercial building development. Per-square-foot expenditure data from the National Council of Real Estate Investment Fiduciaries (NCREIF) are compared with total size estimates provided by Newmark to estimate the contributions of existing building operations. An interactive map on the report website illustrates the contributions of new office, warehouse, industrial (manufacturing) and retail building development to the economies of the 50 states and the District of Columbia.

The decline in commercial real estate construction over the past two years has been mostly concentrated in manufacturing and warehousing, which both peaked in 2022 when the combined value of construction starts (hard costs) across the two industrial sectors totaled $163.3 billion. That figure declined to $105.2 billion in 2024 but remains 64.4% higher than the $64 billion value of combined manufacturing and warehousing starts in 2019. It remains to be seen whether recent reshoring-related manufacturing development will decline further in 2025, but slowing warehouse and distribution completions, moderate growth in leasing activity, and stabilizing industrial vacancy rates should present a more favorable environment for new warehousing and distribution projects.

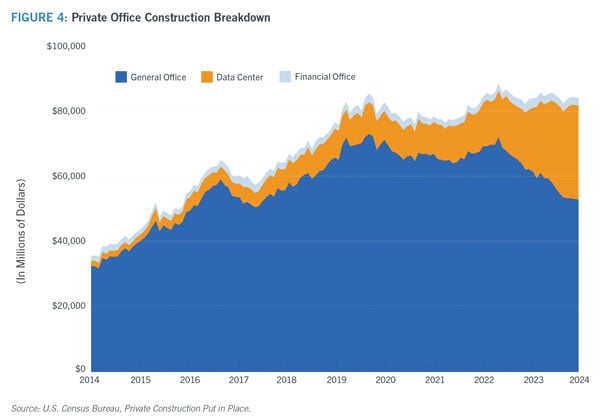

Construction starts data from DCN indicate that new office sector projects in the 12 months ending in September 2024 were 8.5% higher than in 2023. However, most of this growth is likely attributable to data center projects, which DCN categorizes as office construction. The U.S. Census Bureau has also categorized data center projects as office construction in its historical project completions data, but beginning this year, it has begun to break out data center construction from financial office and general office construction. These new data, illustrated in the report and in figure 4 (left), reveal that data center project completions have grown rapidly since the beginning of 2023 and are now equal to about half the construction value of non-data center office projects. Excluding data center projects, the construction value of private office project completions declined 10.2% in 2024 compared with 2023. On the bright side, demand for office space has recently shown signs of stabilizing, and decreased office construction completions should reduce upward pressure on vacancy rates.

Retail and entertainment construction also experienced growth, with the value of starts in the 12 months ending in September 2024 2.2% higher than the total for 2023. Department stores continue to struggle, but the sector overall has performed well. The report highlights growing demand from specialty retailers and smaller-format stores, including among large retailers such as Whole Foods, Target and Best Buy.

To download the report, visit naiop.org/research-foundation.

Shawn Moura, Ph.D., is senior research director at NAIOP.