The Future of Sustainability Includes the Past

The Lower Hill Redevelopment project in Pittsburgh aims to rebuild connections with a historic neighborhood decimated by urban renewal in the 1950s.

Pittsburgh’s Greater Hill District is a community actively reckoning with decisions made decades ago during the postwar urban renewal era. Stakeholders are now looking to lay a new foundation using the three pillars of sustainability: social, economic and environmental.

Socially Sustainable: Restoring Connections

The federal government’s urban renewal practices began after World War II and targeted numerous historic, predominantly Black neighborhoods. Many urban renewal practices were the antithesis of sustainability, defined by racial redlining and demolition that isolated or fractured neighborhoods economically and culturally.

In Pittsburgh, that story played out in the Hill District. Once called the “Crossroads of the World” by Harlem Renaissance poet Claude McKay, it sits between Pittsburgh’s downtown business center and the higher education hubs and medical centers of Oakland. “The Hill” was a flourishing community of jazz, art and commerce. Pulitzer-winning playwright August Wilson set most of his plays in the neighborhood where he was born and raised. The Lower Hill District was leveled in the 1950s to make room for Interstate 579 and the former Civic Arena. In the process, 8,000 people lost their homes and 400 businesses were shuttered.

Bomani Howze is vice president of development for Buccini Pollin Group (BPG), a privately held, integrated real estate acquisition, development and management company that is leading the Lower Hill Redevelopment project. Howze is also a lifelong Hill District resident; his parents and grandparents were among those displaced from the Lower Hill in the 1950s.

An aerial rendering of Block E, with FNB Financial Center positioned on the left. Buccini Pollin Group

“The impact was devastating for my family and hundreds of others,” Howze said. “My grandparents spent years building a home and business that were bulldozed in a matter of days. A whole community was thrown off the path to sustained economic prosperity and segregated from the rest of the city.”

Modern social sustainability requires reconnection, plus the reversal of past harmful practices and the promise of economic opportunities.

In Pittsburgh, developers, consultants and community leaders spent years working together to formulate the Community Collaboration and Implementation Plan, a road map for community benefits that included guidelines on everything from site usage to workforce development.

The team behind the project unites several prominent stakeholders in the commercial real estate industry: Wilmington, Delaware-based developer BPG, minority-owned investor Clay Cove Capital, F.N.B. Corporation, design firm Gensler, and the National Hockey League’s Pittsburgh Penguins, to which the city granted development rights for the site in the early 2000s during negotiations for the team’s new arena. The Penguins chose BPG to lead this redevelopment due to the company’s experience with urban, mixed-use and entertainment-anchored projects in other markets with similarities to Pittsburgh.

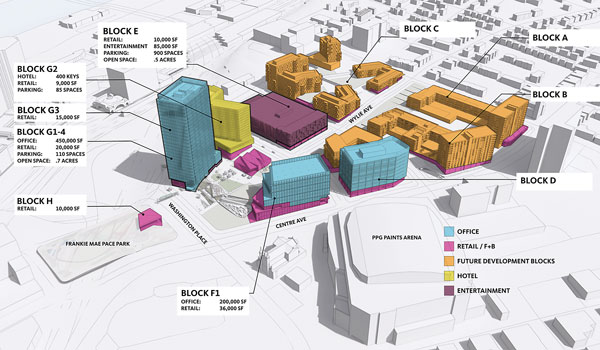

The 28-acre mixed-use site will eventually include nearly 1 million square feet of state-of-the-art office space; market-rate and affordable housing units; a live music venue; and a public safety center, in tribute to Freedom House Ambulance, the nation’s first advanced life support ambulance service, founded just blocks away by Black Hill District paramedics in 1967.

Where passersby once peered out over parking lots, the 26-story Class-A FNB Financial Center now connects the Hill District and downtown’s business district from its prominent location adjacent to the recently completed, $30 million Frankie Mae Pace Park above I-579. The tower, both LEED Silver certified and equipped with SMART technology, is a catalytic development for the project. Slated to open this summer, the $250 million FNB Financial Center will be Pittsburgh’s first modern, multi-tenant high-rise in four decades. The next area of focus will be the groundbreaking on entertainment and infrastructure elements on Block E (see site rendering, below), scheduled for later this year.

From left: Amachie Ackah, co-founder, Clay Cove Capital; Chris Buccini, president, BPG; Kimberly Ellis, Ph.D., director of community, arts and culture, BPG; Bomani Howze, vice president of development, BPG. Buccini Pollin Group

“Ultimately, this project presents an opportunity for all stakeholders to collaborate and invest in the community’s future,” said Chris Buccini, president at BPG. “It is raising the standard for redevelopment in similar high-profile settings as development teams seek to integrate history and legacy with sustainability concepts.”

The development partners envision the $1 billion Lower Hill District connecting the wider area through activated green spaces, pedestrian-friendly retail corridors and multi-modal, urban environments. The project includes convenient access to services and amenities within walking distance, and ample transit options encompassing bus, light rail and future bus rapid transit.

Economically Sustainable: Reinvestment

To be economically sustainable, a project must create shared prosperity and realize the potential for wealth-building. This is especially important in communities that have experienced disinvestment.

A large project can be a catalyst for inclusive contracting opportunities and workforce development. The Lower Hill project team engaged diverse contractors. Forty percent of project contracts to date (approximately $45 million) have been awarded to minority- or woman-owned business enterprises. That includes $25 million to Black-owned businesses, many sourced from the Hill District and surrounding neighborhoods. At the same time, the construction firms on the site work closely with trade schools, labor unions and local nonprofits to attract new workers through a range of workforce development and training programs.

Large-scale neighborhood development also benefits from immediate, upfront investment. The Lower Hill team developed a unique financial process that conveyed property tax abatements from the developers into a community-directed reinvestment fund. By monetizing the tax incentive upfront using a loan, the team delivered more than $7 million into the Greater Hill District Neighborhood Reinvestment Fund upon breaking ground. The fund will be used, in part, to support urgent property improvements for existing neighborhood residents and gap funding for community-led, mixed-use development across the Greater Hill District.

A site plan for the Lower Hill Redevelopment project. Buccini Pollin Group

“A lesson of the Hill District experience is that development decisions reverberate for a long time. For my family, it’s had a negative impact for 70 years,” Howze said. “But the same can be true of positive opportunities. When a young person starts a career in the building trades, when an entrepreneur gets their big break with a large contract, when a resident can stay in their home because they had help replacing their roof — all those things are seeds that we have planted with this project.”

Environmentally Sustainable: Resource Integrity

A major aspect of environmental stewardship for the project includes a highway cap project over I-579 that physically reconnects the Hill District with downtown via a public park named for Frankie Pace, a longtime Hill District advocate.

“Stormwater runoff is a chronic problem in Pittsburgh. Our goal is to minimize the impact on streams and rivers,” said Craig Dunham, senior vice president of development for the Pittsburgh Penguins. “The Frankie Pace Park project is in part a storm-water project that directs the runoff back into the ground from what once was surface parking and the highway. A similar approach is being taken with our new streets and open areas. We are redeveloping an urban site that stitches together streets and neighborhoods into a healthy mixed-use community, which is by far the most sustainable way to go about development.”

The master plan earned LEED Neighborhood Development Gold designation, and the team is pursuing a buildout of the development in support of this standard.

FNB Financial Center features glass with high-insulating properties while delivering daylight and visibility to tenant areas to create a high-performance facade and more vibrant workspaces. To reduce energy consumption, the project is deploying high-efficiency HVAC systems and lighting throughout the building.

“We’re trying to tell the story of what happened here and create cultural connections between the new neighborhood and the historic neighborhood,” Dunham said. “It’s now all about building sustainable, healthy communities.”

Boris Kaplan is the senior vice president for development for Buccini Pollin Group.

By the numbers:1 million square feet commercial/office 250,000 square feet entertainment/retail 1,200 residential units 400 hotel guest rooms Timeline:Opened in 2024: FNB Financial Center and open space Breaking ground in 2024: Future mixed-use |