Construction Costs Cool Down — but for How Long?

While materials costs have largely moderated, labor expenses continue to rise.

Developers and contractors alike were able to rest a bit easier in 2023 after the nonstop cost increases of the previous three years turned into flat or falling prices for many items. Prices remained relatively tame in early 2024, but there is reason to expect the relief will not last.

The pandemic triggered abrupt and extreme changes in supply chains, labor availability and consumer preferences for living and working conditions and locations. As a result, the cost of many materials soared to new heights. Meanwhile, supply bottlenecks pushed out project completion dates, adding to labor and financing costs, while depriving owners of revenue to cover those costs.

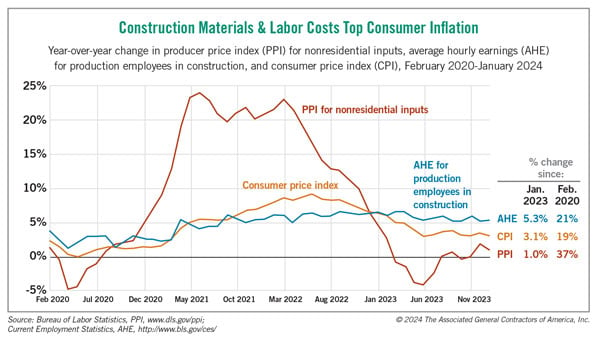

Although households felt the sting of the steepest consumer price index (CPI) increases in decades, the cost impact was even more severe for construction. Consumer inflation topped out at a year-over-year rate of 9.1% in June 2022. In contrast, the producer price index (PPI) for inputs to new nonresidential construction posted increases of 20% or more 12 months in a row, from May 2021 through April 2022. The PPI is a weighted average of the prices at the producer or distributor level for all materials used in nonresidential construction, along with services such as design and trucking.

The picture reversed in 2023. While the CPI decelerated to a 3% annual rate, the PPI for construction inputs turned negative, with prices that fell below the year-earlier number in several months.

The PPI began creeping higher at the end of 2023 and rose 2% from February 2023 to February 2024. Two major classes of materials that contributed to the turnaround were concrete products, which rose 6.6% over 12 months, and steel mill products, which climbed 5%.

While supply chains have generally functioned much better than in 2020-2022, there are exceptions. Lead times have remained extremely long for major electrical components such as switchgear and transformers. Some contractors and owners have also reported problems obtaining parts for elevators and air-handling equipment. Most recently, mineral-wool insulation manufacturers have stopped taking orders and have warned of delays or allocations in delivering materials.

One important aspect of construction costs has not slowed significantly: wages. The Bureau of Labor Statistics (BLS) reports each month on average hourly earnings for production and nonsupervisory employees — a figure that tracks wages paid to construction craft workers and hourly office workers. This measure of wages has risen at roughly a 5% annual rate for the past three years, the most since 2007.

These increases are likely to persist throughout the rest of 2024, if not longer, even though wage increases in the overall private sector have moderated in the past year or two. One reason is that construction is still experiencing severe shortages of workers. BLS reported on April 2 that there were 414,000 job openings in construction at the end of February, the highest February total in the 24-year history of the series. Additionally, union contracts negotiated in 2023 and 2024 are building in much higher annual increases over the next three years compared with the agreements that were signed in pre-pandemic days.

In summary, materials costs have moderated from the whiplash-inducing increases of a few years ago, but they are no longer descending, on balance. At the same time, labor costs are continuing to rise at a higher rate than before the pandemic.

Ken Simonson is the chief economist with the Associated General Contractors of America. Contact him at ken.simonson@agc.org.