Contractors Upbeat About Infrastructure but not Commercial Projects

Survey results also identify ongoing — though slightly improved — challenges with the supply chain.

Heading into 2024, construction firms were optimistic, on balance, about demand for projects — especially infrastructure and other public works. However, that positive attitude did not extend to most developer-funded construction, based on nearly 1,300 responses to a survey the Associated General Contractors of America (AGC) released near the beginning of January.

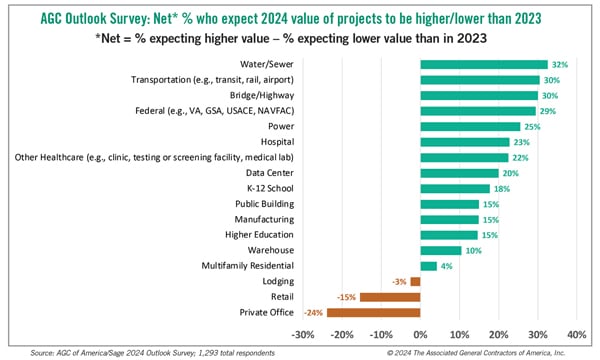

AGC member firms, which perform every type of construction other than single-family, were asked if they expect the dollar value of projects available for bid to be higher or lower than in 2023. For 14 of 17 project types, a larger percentage of respondents expect the market to expand than expect it to shrink. AGC summarized the difference between these percentages as a net reading.

The most widespread optimism was for water and sewer projects, with optimists outnumbering pessimists by 32 percentage points. Close behind were net readings of 30 each for bridge/highway and other transportation projects such as rail, airport and transit facilities. Optimism also ran high for work for federal agencies, with a net reading of 29.

Among predominantly private-sector categories, the highest reading was for power projects, at 25 percentage points, followed by hospitals (23) and other health care projects such as clinics, testing or screening facilities, and medical labs (22).

Enthusiasm was less widespread for three segments that provided a substantial amount of work for contractors in 2023. Data centers received a net reading of 20, while manufacturing construction earned a score of 15 and warehouses drew a reading of 10.

Contractors were mostly bearish regarding rent-dependent properties. The net reading for multifamily construction was a positive 4 percentage points, whereas three other segments had negative readings: -3 for lodging, -15 for retail and -24 for office construction.

Only a quarter of participants reported no supply chain problems. However, this marked an improvement over the 2023 survey, when 90% of respondents reported taking steps to deal with supply chain disruptions. The most common response to supply chain issues in the 2024 survey was accelerating purchases after winning contracts, listed by 56% of respondents. In addition, 45% reported turning to alternative suppliers. (Participants could select any or all of four responses if they reported having supply chain issues.)

More than 1 out of 10 respondents listed specific items that were problematic. The most frequently cited items were electrical equipment such as switchgear and transformers. Numerous participants listed heating, ventilation and air-conditioning equipment as problematic.

Nearly two-thirds of respondents reported that at least one of their projects had been postponed or canceled in 2023 or had been scheduled for 2024 but put off. The most frequently identified reason — cited by 53% — was rising costs, whether for construction, insurance or other reasons. Rising interest rates were listed as a factor by 39% of participants, and 34% reported reduced funding availability.

Developers and project owners need to be aware of these continuing supply chain challenges and prepared to promptly authorize or, at minimum, discuss the strategies contractors propose for mitigating the problems. Responses to numerous other questions, along with breakouts by location and other factors, are available at www.agc.org.

Ken Simonson is the chief economist with the Associated General Contractors of America. Contact him at ken.simonson@agc.org.

RELATED ARTICLES YOU MAY LIKE

Navigating the AI Revolution: A Blueprint for Real Estate Executives

While artificial intelligence reshapes industries globally, commercial real estate is at a crossroads of adapting swiftly or being left behind.

Read More

NAIOP Research Directors Discuss an Industry in Transition

At their annual meeting, research directors shared their outlooks for capital markets, office, retail and industrial real estate.

Read More

Demand Remains High for Construction Workers

Firms with openings for craft workers report challenges in filling those positions.

Read More