A lack of clear succession planning could mean the end of the line for some private real estate firms.

According to AARP, 10,000 baby boomers are reaching retirement age every day, a trend expected to continue into the 2030s. This reality represents an existential challenge and an opportunity for real estate companies that are founded, led or managed by baby boomers.

Research conducted by the Family Business Alliance indicates more than 30% of family-owned businesses make the transition into the second generation, but only 12% are viable by the third generation and only 3% by the fourth generation and beyond. Furthermore, the average life span of S&P 500 companies decreased from 67 years in the 1920s to only 21 years in 2020.

Many factors contribute to these statistics regarding company longevity, but one major reason that certain real estate companies do not stand the test of time is a lack of clear and effective succession planning.

At many real estate companies formed over the past 50 years, family-owned or otherwise, baby boomer owners and leaders are facing retirement. As they retire, significant gaps in talent, knowledge and skills will result. Most public REITs maintain formal/proactive succession plans dictated by the public markets and the fiduciary responsibility (and liability) of their boards to company shareholders and investors. However, many private real estate companies are ill-prepared for the threat that this silver tsunami of retirement poses to their continued survival.

Succession Planning

Succession planning is a strategy for passing each key leadership role within a company to someone else in such a way that the company continues to operate smoothly after the incumbent leader is no longer in control. Simply put, the process involves establishing a purposeful plan to grow, groom or get the next generation of leaders or owners, and to ensure the continuity of the business in the event of either anticipated turnover (such as an executive’s retirement) or unexpected turnover (such as the sudden death of an executive or their departure to another firm).

Companies that maintain continuity in their leadership and consistency in their culture are generally able to execute their strategies consistently, while those that are constantly churning through managers have a much tougher time executing their strategies.

There are two different kinds of succession plans, and every company should have both.

Emergency/contingency succession plans are designed to:

- Deal with unanticipated vacancies

- Handle the legal transfer of ownership/assets

- Potentially initiate an orderly liquidation or rationalization of company businesses or real estate assets

- Install temporary leadership and governance

Proactive succession plans are designed to:

- Ensure confidence and continuity of leadership

- Highlight individuals/positions at risk

- Identify potential successors

- Generate purposeful mid- and long-term plans to fill gaps

At a minimum, emergency/contingency plans should deal with legal transfer of ownership. In some cases, these plans prescribe an orderly liquidation of the company’s assets or a divestment of high-risk activities and business lines in the absence of a knowledgeable steward of these industry roles. Effective emergency plans should specify how the company is going to operate in a period of transition. Who is empowered to make what decisions and under what circumstances as a fiduciary to the nonactive company stakeholders? Should the board step in and appoint a temporary CEO while initiating a search for a replacement, whether that’s an internal candidate or an external hire?

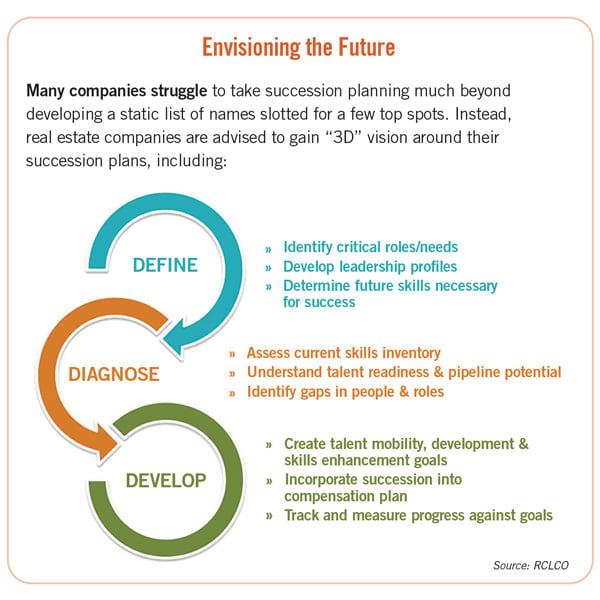

Many companies talk about long-term/proactive succession planning, but the key is to make it operational. This type of plan is not a one-and-done activity but rather an ongoing process that needs to be kept current. The most effective way to minimize the impacts of lost leadership is to develop a program to identify and foster the next generation of leaders through mentoring and training so they are ready to take the helm at the appropriate time.

Succession plans should be updated annually (at minimum) or as changes dictate. RCLCO has found that most companies have 25% to 50% of their workforce ready to assume the role for which they are being groomed.

Successful Examples

Two of the most challenging succession planning issues are the replacement of a CEO and the introduction of family successors into a real estate organization.

Horning, a family-owned, Washington, D.C.-based residential and commercial real estate company, was led for over 40 years by its co-founder, Joseph F. Horning Jr. In 2002, he ushered a successful leadership transition to a nonfamily member CEO who had served previously as the company’s chief financial officer. In 2023, when this CEO announced he was ready to move on, the company once again looked outside of the family for its next leader because no one in the second generation of the Horning family had an interest in a real estate career.

With a full year to plan the succession, the outgoing CEO made all of the necessary preparations, both with the internal team and external stakeholders, to allow for a smooth transition. The family-run board was intentional with its search process, ensuring that its executive search partner was invited inside the company to understand its culture, goals, portfolio performance and dynamics. As a result, there was clarity in identifying candidates who would fit from both a culture and skills perspective. The family selected Jamison Weinbaum, who has gained the team’s trust during his year as CEO, and the company continues its successful operations.

Transition of family ownership/leadership from one generation to the next can also be a challenge for many real estate organizations. The involvement of family members can be a touchy subject in the context of strategic planning. The Bozzuto Group, a fully integrated multifamily development, construction and property management and homebuilding company operating in the Mid-Atlantic and Northeast, offers an example of how to navigate this challenge successfully.

Toby Bozzuto succeeded his father, Tom, one of the company’s co-founders, in September 2015, but the plan had been in the works for years. Tom encouraged Toby to first pursue a successful career elsewhere and to get the requisite education, including a master’s in real estate from New York University. Once Toby joined the family company, Tom made it clear that he intended for his son to take over his ownership stake in the business and assume leadership of the firm one day. Addressing these intentions openly in the context of a strategic planning process was beneficial to the organization because no one had to guess what the plan was for succession.

Common Pitfalls

A mistake many business owners/leaders make is to bring their children into the family business and hand them titles, responsibilities or compensation that they don’t deserve. Valued team members who don’t share the same surname may resent the unearned station of these offspring and may leave the business, assuming there is no future for them.

In another case, a private family-owned company didn’t have an emergency succession plan. When the second-generation president died unexpectedly, there were no instructions or rules of engagement left behind to guide key decisions, including stewardship of the company and its portfolio. In the wake of this tragic loss, the company had a string of “interim” nonfamily member presidents who were not aligned with the wishes of the family stakeholders. As a result, the company lost 10 years of what should have been productive growth coming out of the Great Recession.

Familial Advice

For those wrestling with inviting family members into their real estate organizations and thinking about long-term succession, here are some key lessons:

Be qualified for the job. It is important for adult children entering the business to have a few years of business experience. They need to be qualified for the position.

Do your homework. Tom and Toby Bozzuto took a course on families in business at Harvard Business School and recommend seeking out similar courses.

Step aside. Parents need to recognize there is a window of opportunity for a successful transition. Waiting too long may lead to the adult child taking a position elsewhere. This doesn’t mean the senior family member must retire, but they should be ready to step aside and take another role, perhaps on the board of directors, once the heir apparent is in their 30s or early 40s.

Reward nonfamily team members. Much of succession depends on focusing not just on the CEO but also on the entirety of the organization. If not handled appropriately, the term “family business” can feel restricting to those who aren’t family members.

Be transparent. Talk openly about the upcoming succession and give people an opportunity to react appropriately. There should be no doubt in anyone’s mind about what is ultimately going to happen. Have a timetable, but don’t be too hasty.

Be patient. Plan ahead, as a smooth succession can take awhile.

Ellen Klasson and Charles Hewlett are managing directors at RCLCO.