The Silver Tsunami and Investment Opportunity in Senior Housing

A convergence of demographic trends, economic factors and market dynamics could boost investor confidence.

As the United States braces for a demographic shift of historic proportions, the senior housing industry stands on the cusp of immense challenge and opportunity. Over the next 25 years, the number of Americans 80 and older is projected to soar, adding nearly 17 million new octogenarians by 2050.

Emerging from the shadow of the pandemic — with labor shortages easing and interest rates softening — a ripe landscape is unfolding for investors. Senior housing is poised to become one of the most profitable real estate asset classes, yet the current pace of development suggests a looming shortfall that could reach 550,000 units by 2030.

The Coming Age Wave and Supply-Demand Imbalance

With the first wave of Baby Boomers turning 80 in 2025, the demand for senior housing is increasing and will continue for decades. Providing reliable housing and quality medical care for this burgeoning population is not merely a multibillion-dollar opportunity for industry stakeholders; it’s an urgent national necessity.

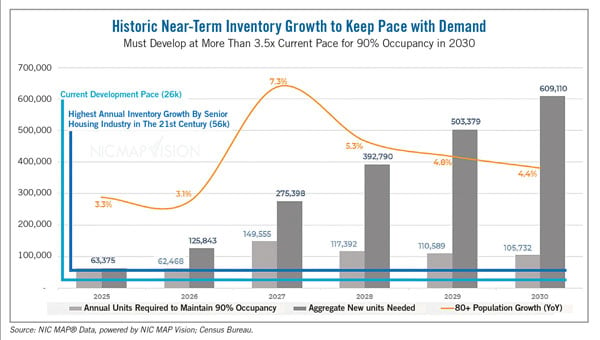

In its senior housing market outlook published this past summer, NIC MAP Vision, an analytics and insights partner for the senior housing industry, reported that development must accelerate more than 3.5 times the current pace to meet projected demand over the next six years. Currently, only 26,000 units are being developed annually — far below the peak rate of 56,000 units earlier this century. If this trend continues, the industry is on track to fall 50% short of the needed inventory in 2025.

To confront this looming demand tsunami, historic near-term inventory growth is imperative, necessitating unprecedented investment and a substantial influx of capital. In recent years, senior housing has faced barriers in attracting investors from the capital markets, which have posed significant transactional challenges. However, with interest rates softening, this dynamic is shifting, opening doors for enterprising collaboration.

An Environment for Strategic Investment

As the aging population surges, absorption rates — the net change in occupied units — are soaring. In the third quarter of 2024, over 6,500 senior housing units were absorbed in NIC MAP Vision primary markets. Eight of the past 12 quarters have exceeded 5,500 units absorbed — a threshold never surpassed before 2020 in NIC MAP Vision’s data. Clearly, past and current development rates are insufficient to meet the imminent demand. To maintain 90% occupancy by 2030, the industry must develop at nearly double its historical maximum pace.

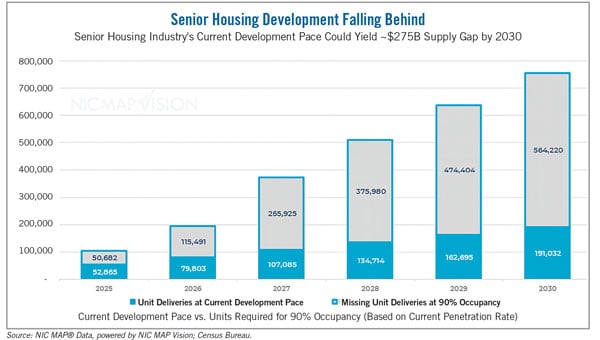

Despite robust absorption and occupancy growth signaling promise, high interest rates and limited capital have stunted senior housing construction starts, approaching lows not seen since the Great Recession of 2008. Given multiyear predevelopment and construction timelines, supply growth will likely remain depressed for years. Without the necessary investment, a $275 billion supply gap will emerge by 2030.

Seizing the Opportunity

The current supply-demand imbalance stems from a perfect storm: unprecedented growth in the aging population, the ripple effects of the global pandemic, and dislocated debt markets that suppressed investment activity. Paradoxically, this convergence has created an ideal environment for collaboration among creative, enterprising and problem-solving professionals.

Senior housing is a highly specialized asset class, demanding genuine expertise and effective relationships among stakeholders who understand the product. This unique landscape has posed barriers in the past. However, commercial real estate professionals and investors who collaborate now to unlock the necessary capital will be addressing one of America’s most pressing issues while also creating opportunities for significant near-term capital appreciation.

Projections for senior housing occupancy remain consistently positive as fundamentals — driven by demographic, economic and sectoral trends — continue to surge. Yet a significant investment gap, potentially reaching $800 billion by 2050 if the current development pace is maintained, underscores the necessity for an industry-wide effort to develop new inventory that meets the needs of the aging population. Institutional investors, REITs and private equity will be crucial in increasing capital allocation to the sector.

Engaging Investors and Overcoming Barriers

Building investor confidence is integral to the sector’s continued expansion and success. A key strategy is providing comprehensive market data that reflects unprecedented demand growth and expanding margins. Public markets have already recognized the opportunity within senior housing — a direct barometer of investor sentiment. Public market valuations of senior housing equities exceed pre-pandemic levels, and current REIT dividend yields are well below the 10-year U.S. Treasury, suggesting significant near-term capital appreciation.

One of the most significant barriers for investors has been the challenge of transacting in the capital markets. High interest rates and a freeze in capital availability have slowed transactions over the past year. However, significant amounts of dry powder are waiting to be deployed. Overcoming these capital market challenges will be crucial moving forward.

While senior housing developments occasionally face community opposition, they are generally viewed as sympathetic and necessary projects. Many zoning cases that might fail for other housing types are more likely to succeed for senior housing due to the clear societal need. Communities recognize the importance of providing health care and living spaces for seniors, making opposition to them less intense compared with other real estate uses such as multifamily residential developments.

Investment Performance

In recent years, senior housing has delivered strong investment returns, even in the face of economic disruptions. According to data from the National Council of Real Estate Investment Fiduciaries (NCREIF), senior housing produced double-digit returns in several key time frames, including nearly 14% in the three years following the Great Financial Crisis. Over the past decade, the sector has consistently outperformed other real estate categories like retail, office and industrial. Most notably, according to NCREIF, the 10-year annualized return for senior housing exceeded 12%, an indication of the sector’s ability to generate stable, long-term returns for investors, even amid broader market volatility.

The sector’s resilience is also evident in its rapid rebound following the COVID-19 pandemic. Unlike other industries that struggled to regain pre-pandemic levels, senior housing saw a swift recovery in penetration rates, reflecting renewed consumer acceptance and demand for housing in the 80-plus age group. This is not merely an occupancy rebound but a resurgence in customer willingness to enter senior housing environments. According to NIC MAP Vision data, within five quarters of vaccine rollouts, penetration rates and total absorption returned to near pre-pandemic levels, reinforcing the need-based nature of the sector. Senior housing’s ability to recover quickly further emphasizes its durable demand and value as a resilient asset class.

Investors and industry stakeholders have a unique opportunity to address a critical societal need while reaping significant financial rewards. The convergence of demographic trends, economic factors and market dynamics has created an ideal scenario that savvy investors can navigate to their advantage.

Arick Morton is the CEO of NIC MAP Vision.