Tracking Conversions to Multifamily

Recent data suggest office buildings are becoming more attractive conversion targets.

Interest in conversions to apartments has surged since 2020 as other commercial uses, especially office, continue to underperform while the demand for housing has been sustained. Although conversions do not account for a significant portion of new multifamily supply — only about 35,000 units, or 4%, of the total constructed from 2020 to 2022, according to Statista — they represent strategically important projects for many urban neighborhoods.

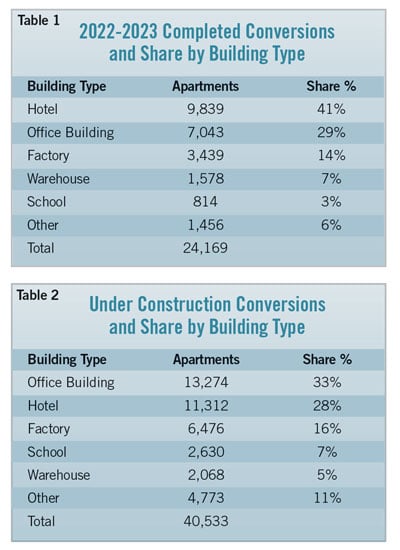

Data from Yardi Matrix, which tracks all multifamily projects of 50 units or more anywhere in the U.S., are available for completed projects during the “late Covid” period since 2022. These projects generated over 24,000 apartment units (see Table 1). Converted hotels account for the plurality of converted units for these two years. Office conversions, which accounted for the most converted units of any prior use from 2013 to 2022, are second. Together, hotels and office buildings represented 70% of all converted units.

Yardi also collects data on projects that are planned (announced), prospective (seeking entitlements) or under construction. Together, these tally 151,289 units in 926 buildings — over six times the number of conversions during the past two years. Limiting the focus to buildings under construction provides an accurate forecast of conversions that will be completed in the 2024-2026 time frame (see Table 2). The pace of all conversions is about the same as in 2022-2023 (about 12,000-13,000 units per year). However, office conversions are expected to increase from about 3,500 annual conversions in 2022-2023 to 4,425 units over the next three years. This uptick suggests office buildings have become more attractive conversion targets, likely due to lower acquisition costs per square foot.

Location of Converted Office Buildings

Since most attention has been devoted to office conversions, it is interesting to review the data on recent conversions and conversions under construction. Regarding office conversions completed in 2023, the five metro areas that produced the most apartment units were Atlanta (295), Milwaukee (216), Indianapolis (216), Washington (212) and Cleveland (202). As for office conversions under construction, the top five metros by units expected are Dallas (864), Cincinnati (778), Houston (683), Washington (675) and Birmingham, Alabama (596).

Office Building Age

Previous research on office conversions (see “Relevant Research”) indicated that the median age of the converted building was over 80 years old, with one mode before 1930 and the other mode between 1960 and 1990. The 60 office building conversions completed in 2024 are distributed in a very similar manner. The bimodal distribution has 23 buildings built before 1930, seven built between 1930 and 1960, 25 built between 1960 and 1990, and the remaining five built after 1990. (The oldest buildings converted in 2024 were factories and warehouses.)

Older office buildings have many features that make them attractive conversion candidates, including less total square footage, smaller floor plates, central cores, functioning windows, sites allowing significant natural light penetration, and architectural significance. Buildings constructed between 1960 and 1990 often have significant physical, functional or economic obsolescence and possibly deferred maintenance. Because replacement of major systems is a significant expense, the comparative cost of conversion makes them strong candidates.

Other Issues

Compared with new construction, especially when demolition of existing structures is required, adaptive reuse has many advantages. The environmental impacts are lower, whether considering greenhouse gas emissions, carbon footprint or other factors. Existing structures continue to be productively used instead of being razed. On the other hand, while multifamily conversions increase overall supply, they rarely provide housing that is affordable by conventional metrics.

Of considerable importance is the significant reduction of development period risk, mitigating one of the most serious concerns for real estate developers. In many instances, new projects that would take three or more years to plan, entitle, build and lease can be brought to market in two years or less as a conversion.

In addition, conversions can deliver apartments at 20% to 30% lower cost than new construction depending on project particulars. Parking sized for prior office use is almost always more than adequate for the number of new apartments.

Still, office conversions are complex, costly projects. Gensler, which has developed a detailed methodology for assessing office building conversion potential, finds that fewer than 20% are ideal candidates depending on the particular city (the Gensler Design Exchange podcast episode “Office-to-Residential Conversions: Mandates, Myths, and Possibilities” offers more details). Public subsidies are often required to achieve feasible deals.

Case Example

The largest office conversion to date in New York City is Pearl House at 160 Water Street. Vanbarton Group and Gensler teamed to transform this underutilized 24-story office building into a 30-story building that includes 588 apartments and 40,000 square feet of amenity space. Pearl House opened earlier this year, with monthly rents for one- or two-bedroom apartments in the $6,000 to $8,000 range.

Emil Malizia, Ph.D., CRE, is a NAIOP Distinguished Fellow and a research professor at the University of North Carolina at Chapel Hill. All data on multifamily conversions were provided by Doug Ressler, senior research officer, Yardi Matrix. The author thanks Mr. Ressler and Yardi Matrix for their assistance.

Relevant ResearchThe NAIOP Research Foundation published “New Uses for Office Buildings: Life Science, Medical and Multifamily Conversions” in 2022 to evaluate the risks and opportunities associated with office building conversions. The author, Emil Malizia, Ph.D., conducted a review of publications and market data on office conversions and interviewed developers, architects and other commercial real estate professionals to provide an overview of key considerations for converting office buildings to other uses. To view or download the report, visit naiop.org/research-and-publications/research-reports. |

The Revitalizing Downtowns and Main Streets ActA bill spearheaded by NAIOP and its members was introduced in July in the U.S. House of Representatives. The bipartisan Revitalizing Downtowns and Main Streets Act is sponsored by Reps. Mike Carey (R-Ohio) and Jimmy Gomez (D-Calif.). The proposed legislation includes:

|