while the developer is waiting on permitting. Courtesy of Green Donation Consultants and Recyclean, Inc.

Deconstructing rather than demolishing buildings can present both financial and environmental advantages.

In the current economic environment — with rising materials and labor costs, combined with challenges in financing — developers are facing serious headwinds. Some are mitigating these challenges by generating additional income through the demolition process itself.

While traditional demolition methods reduce prior structures to rubble, deconstruction involves dismantling a building piece by piece, with up to 90% of the collected materials being donated and used again. The donations not only keep these materials out of landfills but can also offset demolition costs in a net positive way due to the high demand for quality used building materials.

The Benefits of Reuse

With the expiration of lease terms from pre-COVID tenants on the horizon, many office buildings are having difficulty maintaining their marketability. But how much value lies on the inside of these properties?

Deconstruction firms are starting to see more interest in this opportunity. It is becoming more common for developers to purchase office buildings for little more than the value of the materials extracted during a conversion or repurposing process.

Top: Green Donation Consultants and Recyclean, Inc. recently completed the full deconstruction of a commercial office property in Chicago, including foundation removal; bottom: an architectural rendering of the new building, which will include business and residential uses. Courtesy of Green Donation Consultants and Recyclean, Inc.

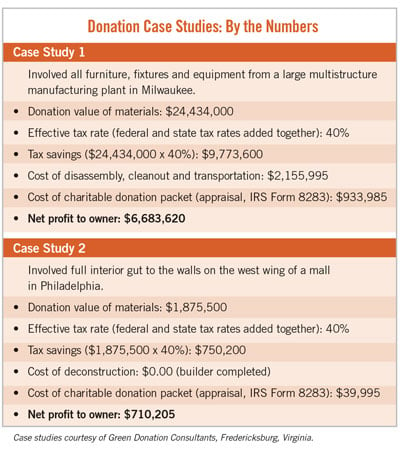

For example, the purchase of a large commercial building in Libertyville, Illinois, recently resulted in a net positive for a local commercial management firm. The commercial campus had over 1.1 million square feet of space and was purchased fully furnished for $9.5 million. By donating desks, fixtures, flooring, electrical systems, windows, doors and other building materials, the company received an $8.9 million tax deduction. The management company’s net profit amounted to $2.36 million after the building was stripped and made ready for build-out.

The value of these structures lies in the fact that builders are facing two main challenges in the current economy: the struggle to find affordable building materials and the lack of quality and durability in new materials.

The lumber industry is facing restrictions due to concerns about increased carbon emissions and deforestation. Additionally, supply chain interruptions from the COVID-19 pandemic are still a concern. These factors are contributing to the rise in cost of new materials. In a challenging economy, budgets are becoming tighter, creating more pressure to find affordable building materials.

Previously thought to be a niche market, the demand for used building materials is climbing. The reclaimed lumber market alone is expected to be worth $98.1 billion by 2033, and other materials like stone, brick and piping are fetching higher prices than ever before.

Deconstruction also provides a practical way for developers to demonstrate their investment in a community. Deconstruction firms collaborate closely with government organizations and nonprofits like the Federal Emergency Management Agency, Habitat for Humanity, the Salvation Army and others that create affordable housing, multiuse buildings, schools and other vital community infrastructure with limited budgets.

Navigating Timelines

The demand for deconstruction as a sustainable alternative has surged within the last decade. Since 2016, several cities, including Portland, Oregon; San Jose, California; Milwaukee; and San Antonio, have established deconstruction ordinances requiring either all or a proportion of buildings set for demolition to be disassembled instead. More than 400 deconstruction companies and supporting organizations currently provide this service nationwide.

Timeline is often cited as the main driver when weighing between deconstruction and demolition. Traditional demolition offers the comfort of the familiar, providing a straightforward method to meet a hard deadline. However, deconstruction allows for the process to begin even sooner than demolition. While awaiting permitting, teams can begin on the interior of a property and dismantle fixtures, furniture and other materials without puncturing the skin of a building, putting a project into motion quickly.

Once permits are approved, structural materials can be disassembled in alignment with even tight timelines. Ideally, having 90-120 days from initial inspection to deconstruction is recommended, but the process can be sped up if needed.

Deconstruction can offer a solution for developers needing immediate cash flow and reduce estimated quarterly tax payments in alignment with the final tax benefit assessed at the start of a project. If revenue is deferred, the tax deduction can be taken within a five-year span.

Ins and Outs of the Deconstruction Process

The deconstruction process is managed by a personal property appraisal firm with a team of qualified appraisers. These teams have ample experience and connections with local organizations and charities, making the process easy for an already busy developer.

The first step involves a visit to the property by a project inspector who takes photos, measurements and detailed notes to understand the size and scope of the materials to be salvaged. They use this information to present a detailed plan to the developer that includes a proposed value, pricing, and nonprofit organizations that will receive the donated materials.

The cost of deconstruction and the final tax benefit depend on numerous factors, including the size of the property, quantity of materials, quality of fixtures, and the fair market value of those salvaged materials at the time they are appraised.

The sheer logistics of donating these materials from large commercial projects can be complex. One office building can create an enormous amount of inventory, each piece needing to be documented, assessed for fair market value and properly indexed. This detailed documentation process is handled directly by the appraisers, who conduct research to ensure accuracy when determining the value for sometimes very nuanced materials.

Typically, up to 90% of building materials and fixtures can be salvaged, reused or recycled, including brick, lumber, plumbing, artwork, doors, framing, flooring, lighting, and any personal property or furniture on-site. Materials such as drywall, concrete, broken appliances and damaged furniture are not eligible for donation.

Once deconstruction is completed, the nonprofit provides a signed receipt detailing the materials that were donated. The deconstruction firm reconciles the preliminary list with the donation receipt to produce a final donation inventory list. That information is crucial to making a complete determination of the fair market value of the materials.

The appraisal is then compiled into an IRS qualified comprehensive appraisal report, which is submitted with a signed IRS Form 8283 and sent to the developer with instructions on how to submit the final packet.

While deconstruction is a valid avenue for most, some unique circumstances may limit a commercial developer from taking full advantage of the financial benefits. For example, pass-through entities and investment trusts are not eligible to receive deconstruction tax benefits. Additionally, if the building has already been depreciated, tax benefits cannot be applied, and deconstruction may not be as financially attractive.

Alternatively, developers could still capture tax benefits via deconstruction through the ability to earn LEED points, leading to other tax benefits down the line. For property placed in service before Jan. 1, 2023, the deduction is capped at $1.80 per square foot (indexed for inflation after 2020) for buildings with 50% energy savings. Other state or city incentives for LEED certification could benefit developers looking for energy-efficient alternatives.

Capturing All the Benefits

If a commercial developer is considering deconstruction, being prepared with the right information will ensure a smoother process. Having the developer’s accountant or tax team member on the initial call with the project inspector can reveal additional tax benefits that may apply to the project.

The financial benefits of deconstruction, along with its potential to produce a positive impact on the environment and communities, make it a powerful tool for developers to leverage. Given the trend toward environmentally focused practices, deconstruction may one day become the norm rather than the exception.

Rachel Vanni is an attorney turned freelance writer who spotlights companies and industries focused on ESG.