Construction Workforce Challenges Persist

Occupations requiring specialized training or prior experience are particularly hard to fill.

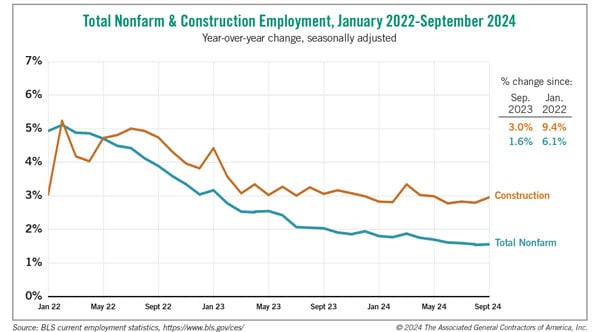

The construction industry has added workers much faster than the economy as a whole for the past two years. Yet contractors say finding workers is their biggest challenge. This lack of workers often means developers don’t get the keys to their projects when they hoped to. Unfortunately, relief does not appear to be in sight, although contractors are expanding their recruitment efforts while also adopting labor-saving technology.

In the 12 months through September, construction employment increased 3%, nearly double the 1.6% rise in total nonfarm payroll employment, as reported Oct. 4 by the Bureau of Labor Statistics (BLS). Employment at nonresidential building and specialty trade contractors — the types of firms most likely to work on developers’ projects — climbed more than 4%.

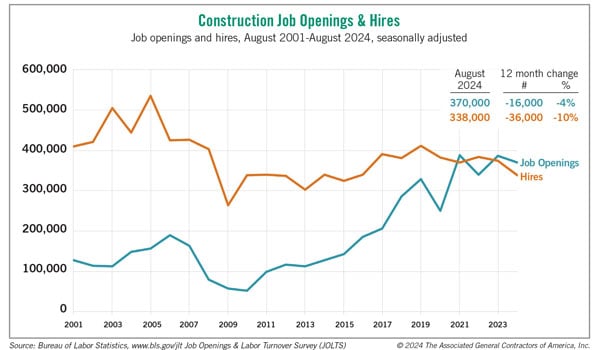

Despite the strong uptick, the construction industry had 370,000 job openings on the last day of August, according to the Oct. 2 Job Openings and Labor Turnover Survey report from BLS. That figure exceeded the 338,000 employees hired during the entire month, which suggests contractors wanted to bring on board at least twice as many workers as they could find.

Efforts to Address Worker Shortages

If anything, worker shortages are getting worse in construction, even as they ease in other sectors. An annual workforce survey the Associated General Contractors of America (AGC) conducted in July and August found that 94% of the nearly 1,500 respondents reported having an opening for hourly craft workers on June 30, up from 85% of respondents in the 2023 survey. Similarly, 79% of firms had an opening for salaried employees in 2024, compared with 69% of respondents in 2023.

The problem is most acute for occupations requiring specialized training or prior construction experience. For instance, 76% of firms that had openings for surveyors in 2024 reported those positions were hard to fill, an increase of 10 percentage points from 2023. Some 78% of firms seeking estimating personnel said those openings were difficult to fill, an 8-point increase from 2023. And 79% of firms with openings for pipefitters or welders reported challenges finding candidates, up 7 percentage points from the year prior.

In contrast, some positions requiring no prior construction experience or training, such as laborers and traffic control personnel, were easier to fill in 2024 than in 2023. As hiring and job openings in other sectors have tapered off, more applicants are likely seeking entry-level construction positions.

To improve their outreach, 57% of respondents reported adding online strategies, such as social media and targeted digital advertising, to connect better with younger applicants. In addition, a majority said they had engaged with career-building programs at the high school, college, or career and technical education level.

In an effort to upgrade employees’ skills faster, 45% of firms said they had implemented or strengthened performance review or performance management. Roughly one-third had implemented career pathing or partnered with a third party for training courses. Around one-quarter had started a new learning program or technology to deliver and track training.

Nevertheless, 4 out of 5 firms acknowledged experiencing project delays. The most common reason, cited by 54% of firms, was a shortage of workers — either their own or workers employed by subcontractors.

Firms are increasingly experimenting with or adopting a variety of robotics, drones, laser- and GPS-guided equipment, and artificial intelligence (AI) to reduce the need for certain occupations or to make workers more productive. A majority of respondents believe AI and robotics will have a positive impact on construction jobs by either automating manual, error-prone tasks or improving the quality of construction jobs and making workers safer and more productive.

However, firms and the AI and tools they adopt have a long learning curve. Developers shouldn’t expect rapid or across-the-board improvements in project completion times.

Ken Simonson is chief economist with the Associated General Contractors of America. Contact him at ken.simonson@agc.org.