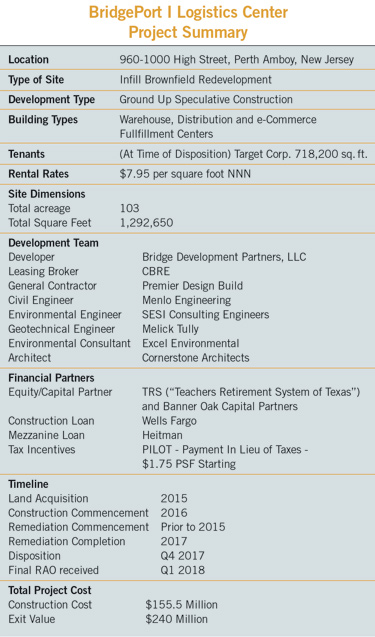

BridgePort I Logistics Center: From Abandoned Brownfield to Active Distribution Facility

A warehouse/fulfillment complex in New Jersey shows the economic potential for infill redevelopment in places once considered environmentally unsalvageable.

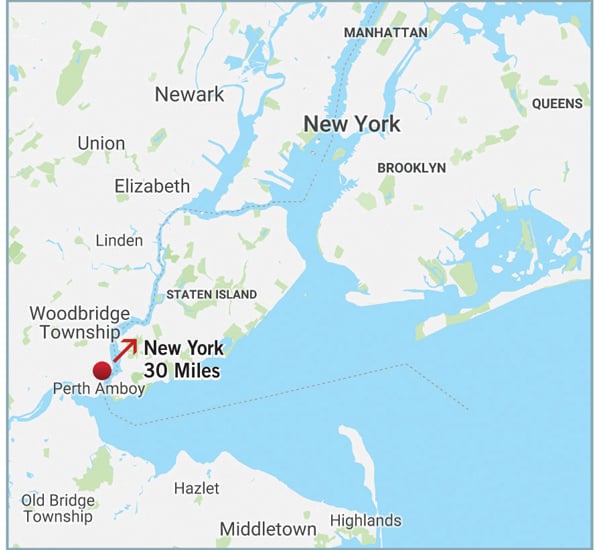

FROM 2015 to 2017, Bridge Development Partners transformed a blighted 103-acre brownfield site in Perth Amboy, New Jersey, into an advanced logistics center that will serve the concentrated consumer base in and around New York City. Bridge overcame complex challenges ranging from environmental contamination to poor geotechnical soil conditions to create a 1.3-million-square-foot distribution facility.

The BridgePort I Logistics Center, which features three buildings with 36-foot clear height ceilings, allows for maximum dock loading, trailer parking and cross-dock layout to accommodate traditional warehouse/distribution users, as well as the operating requirements of the burgeoning e-commerce market. An abundance of parking was designed, including 707 automobile spaces and 449 tractor-trailer parking spaces. It’s situated along Interstate 95 — the busiest highway in the eastern U.S. — in an area poised to draw major regional and last-mile distribution users.

The public-private collaboration behind the BridgePort I Logistics Center demonstrates the economic potential of locations that were once deemed untouchable because of environmental problems. The project accommodates hundreds of permanent jobs and cleaned up a hazardous site that had long been perceived as unsafe by the local community.

Before construction was finished, Bridge executed a long-term agreement with Target for the biggest building at the site, totaling roughly 718,500 square feet. It was one of the largest industrial leases signed in New Jersey in 2017. And in October 2017, Bridge sold the completed three-building project worth $240 million, along with the rest of its New Jersey assets, to Duke Realty as part of a larger national portfolio sale valued at $695 million.

Transforming the Site: Environmental and Soil Remediation

Bridge recognized that the site would be ideal for today’s logistics users if it could overcome the complex environmental and geotechnical challenges that had prevented redevelopment. Led by principal and market officer Jeff Milanaik, Bridge’s New Jersey office assembled a team that included general contractor Premier Design Build Group, Menlo Engineering Associates, SESI Engineering Consultants, Melick-Tully and Associates, Excel Environmental Consultants, and attorneys Wanda Monahan and Lane Miller.

The BridgePort I Logistics Center will provide hundreds of jobs to the Perth Amboy area, as well as more than $2.3 million in annual revenue for the city.

The site was originally home to a copper smelting operation run by American Smelting and Refining Co., that closed in the late 1970s. It sat vacant since that time because it was contaminated by slag, a byproduct of the smelting process, as well as other volatile pollutants.

The previous owner of the site, Viridian Partners, started environmental remediation and identified several areas of environmental concern before Bridge acquired the property in March 2015. After Bridge identified 52 areas of concern, it remediated all the environmental issues and installed the final engineering controls and site cap.

Early in the project, Milanaik and his Bridge team built upon an already-established strong relationship with New Jersey Department of Environmental Protection (NJDEP) officials, particularly the Office of Brownfield Reuse. Milanaik and principal John Porcek have decades of combined industrial redevelopment experience in New Jersey, including work on several Environmental Protection Agency (EPA) Superfund sites. They have worked closely with the NJDEP on a number of successful projects.

The goals of Bridge and the NJDEP were aligned: to ensure that the site was environmentally safe and suitable for development. This collaborative approach helped clear the way for NJDEP/EPA approvals. Pre-existing relationships and a thorough understanding of the state’s rules and regulations were key to obtaining approvals.

One of the major issues Bridge had to address was the site’s poor geotechnical and soil conditions related to its proximity to the Arthur Kill waterway. Due to the high quantity of organic material deep below the surface, the site was considered unsuitable to support development without extensive soil stabilization. Today’s distribution buildings require floor load-bearing capacities in excess of 750 pounds per square foot of floor area. The existing conditions would not allow more than 300 pounds per square foot, which is equal to less than 40 percent of the required capacity.

Soil stabilization can be done fairly economically over a long period of time, but the costs rise substantially under a shorter construction time frame. Bridge took the faster/more costly approach, applying three soil-engineering techniques that are often associated with road building and other complex civil engineering projects:

Surcharging. Large mounds of soils were piled on the building slabs for many months during construction, then redistributed throughout the site when the soil settlement was complete.

Dynamic Compaction. A 14-ton weight was repeatedly lifted by a crane and dropped onto the ground surface, improving the soil density.

Controlled Modulus Columns (CMCs). During construction, Bridge employed CMCs, in which concrete is poured through the hollow center of augers, filling the holes as part of the drilling process. CMCs share the load between columns and the soil around them, adding to the foundational strength, so that they don’t need to be driven into the bedrock. In addition, the CMC auger minimizes the amount of soil spoils, reducing the need to dispose of potentially contaminated soil.

Using these techniques, which took several months to complete, represented about 20 percent to 25 percent of the project’s total hard costs. That’s roughly $15 million to $20 million, or about $12 to $15.50 per square foot.

Complex Financing

The environmental remediation and soil stabilization issues also complicated construction financing. Due to the size and complexity of the deal, Bridge and its equity partners, Banner Oak Advisors and Texas Teachers Retirement System, sought both senior and mezzanine financing. This proved more difficult than anticipated as some lenders were uncomfortable with the project’s level of risk, the size of the remediation and the timing for getting it done.

To secure construction financing, Bridge looked to the expertise of CBRE vice chairman and mortgage banking veteran Steve Roth, as well as existing lender relationships. Bridge’s successful track record as a trusted fiduciary for acquiring, remediating and redeveloping other brownfield sites into modern Class A industrial projects helped convince lenders that the challenges in Perth Amboy could be overcome. Ultimately, Bridge elected to work with Wells Fargo, which held the senior mortgage on the property, and Heitman, which supplied the mezzanine loan for the project.

Advancing Community and Economic Growth

E-commerce and third-party logistics (3PL) firms focused on fast service to consumers and stores have driven record demand for New Jersey industrial space. They seek modern buildings with high ceiling clearance and other up-to-date features to be competitive in an ever-changing delivery model. Their success depends on securing strategic locations near densely populated metropolitan areas to satisfy consumer demand for products.

From the beginning, Milanaik worked with Perth Amboy’s mayor, Wilda Diaz, to ensure that the project would spur employment growth and stimulate the local economy through the realization of new property taxes. During the development period, roughly 300 construction jobs were created. The first tenant, Target, will employ approximately 1,500 full-time people at its facility. The retailer gave jobs to 250 people in its first round of hiring, 65 percent of whom are Perth Amboy residents. The other two buildings were expected to lease quickly, which will likely bring more than 500 additional full-time, permanent jobs to the local community. Since the sale to Duke at the end of 2017, the remaining buildings have been 100 percent leased.

To further ensure the project’s financial viability, Bridge used New Jersey’s Payment In Lieu of Tax (PILOT) real estate tax-abatement program. PILOT eliminates taxes for developers for a set period of time to encourage them to improve the property. Instead, the developer pays a lower “service charge” to the local government during that period. Bridge is currently paying $1.75 per square foot annually to Perth Amboy through the PILOT program. Perth Amboy is already realizing annual revenue in excess of $2.3 million in a location that had been considered unusable.

Additionally, the project’s tenants can take advantage of the Grow NJ Program, which aims to increase and preserve jobs in the state. According to the New Jersey Economic Development Authority, businesses that create or retain jobs under the Grow NJ program may be eligible for tax credits ranging from $500 to $5,000 per job, per year. Bonus credits can range from $250 to $3,000 per job, per year.

These features, combined with the location, were key to attracting Target. The retailer uses the space to restock smaller-format stores that recently opened in all five New York City boroughs. These urban retail locations range in size from 12,000 square feet to 80,000 square feet; by comparison, a suburban Target store is often 150,000 square feet or more. Additionally, the logistics center will help Target refine its online sales and its “buy online, pick up in-store” service (BOPIS).

Jeffrey Milanaik is a principal/market officer with Bridge Development Partners, Northeast Region. Jonathan Pozerycki is director of development with Bridge Development Partners, Northeast Region. Gabie Strbik is the executive assistant/marketing coordinator with Bridge Development Partners in Chicago.

Easy Access to a Major MarketNew Jersey ranks as the third-largest industrial market in the United States by square footage, with consistent tenant demand due to the vast logistical infrastructure network of interstate highways, deep-water cargo ports, air freight and rail servicing the region. The BridgePort I Logistics Center is strategically located in one of the premier gateway industrial markets in the United States and provides unparalleled access to one of the world’s most concentrated consumer bases in and around New Jersey and New York City. Bridge believed that a Class A, modern logistics campus in this location would be ideal for companies and tenants that required a last-mile solution to access the largest residential base in the country.  The BridgePort I Logistics Center in Perth Amboy has easy access to and from Route 440, which connects the New Jersey Turnpike to Staten Island and the other New York boroughs via the Outer Bridge Crossing. Tenant companies have three points of access into New York City from the site, all of which are roughly 30 miles away. The closest is the Holland Tunnel, a 26-mile trip. Even with BridgePort I Logistics Center’s existing transportation connectivity, significant redevelopment and reconstruction of High Street, which connects to Route 440, was still required to secure the viability of the project. In addition to the High Street improvements, a new traffic signal was installed at the end of the off-ramp for Route 440 and High Street. Additionally, roughly half a mile of newly updated water pipes were installed by Bridge. These were required to supply both potable uses and a new 130,000-gallon water tank for the building’s Early Suppression Fast Response (ESFR) fire sprinkler system. |

New Jersey Environmental Approvals ChecklistBelow are the steps Bridge Development Partners went through to receive the go-ahead from the state of New Jersey to obtain occupancy permits for the BridgePort I Logistics Center site, which was built on a former brownfield:

|